Media General, Inc., one of the nation's largest multimedia companies, announced that it has closed on its business combination with LIN Media LLC and the associated transactions.

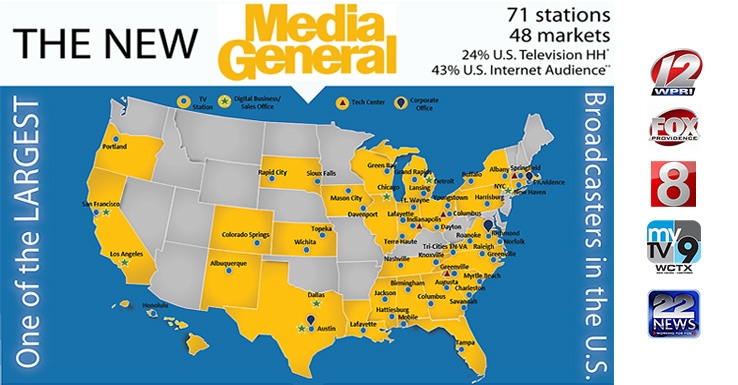

Media General is now one of the nation's largest multimedia companies that operates or services 71 television stations in 48 markets along with the industry's leading digital media business. They offer consumers and advertisers premium quality entertainment and information, content and distribution on every screen. Our robust portfolio of broadcast, digital and mobile products informs and engages 23% of U.S. TV households and 43% of the U.S. Internet audience.

In New England, Media General now officially welcomes WPRI & WNAC in Providence, RI; WTNH & WCTX in Hartford/New Haven, CT and WWLP in Springfield, MA to the family.

This move also means that WJAR in Providence, RI is now officially a Sinclair Broadcast Group owned station.

You can read Sinclair's press release about the station swaps here.

Media General now has the industry's largest and most diverse digital media business with a growing portfolio that includes LIN Digital, LIN Mobile, HYFN, Dedicated Media, Federated Media and BiteSizeTV. These outlets deliver integrated digital marketing solutions utilizing their comScore Top 15 Video and Top 25 Display market share, as well as the latest in content marketing, video, display and mobile advertising solutions, social intelligence and reporting across all screens. With unmatched local-to-national reach, Media General is a one-stop-shop for agencies and brands that want to effectively and efficiently reach their target audiences on all screens.

Commenting on the announcement, Media General’s President and Chief Executive Officer, Vincent L. Sadusky said, “We are pleased to have finalized the merger transaction that delivers numerous strategic and financial benefits, including a strong balance sheet, significant free cash flow, enhanced scale and a diverse geographic footprint that will provide important opportunities to continue growing our business. We look forward to a smooth integration, capitalizing on our new, combined strength and achieving our synergy goals.”

RBC Capital Markets, LLC provided financial advice and Fried, Frank, Harris, Shriver & Jacobson LLP served as legal advisor to Media General. J.P. Morgan provided financial advice and Weil, Gotshal & Manges LLP served as legal advisor to LIN Media.

In addition, Media General announced the preliminary results of the elections made by LIN Media’s shareholders with respect to the consideration to be received by such shareholders in connection with the transaction. The deadline to make such an election was December 18, 2014, at 5:00 p.m. (eastern time). Holders of approximately 46,756,841 shares (or 82.2% of the outstanding shares) made an election to receive the available cash consideration, and holders of approximately 8,748,299 shares (or 15.4% of the outstanding shares) made an election to receive shares of Media General’s voting common stock. Holders of approximately 1,364,887 shares (or 2.4% of the outstanding shares) did not submit a valid election. Because the cash consideration was oversubscribed, each share of LIN Media for which no election was made will be converted into the right to receive 1.4714 shares of Media General’s voting common stock. The preliminary results remain subject to the limitations and proration procedures described in the joint proxy/prospectus of Media General and LIN Media delivered to shareholders in connection with the transaction.

Media General Completes Merger with LIN Media

Typography

- Smaller Small Medium Big Bigger

- Default Helvetica Segoe Georgia Times

- Reading Mode